Rich Dad Poor Dad PDF Free Download 2024

Rich Dad Poor Dad PDF

Author

Robert Kiyosaki

Pages

241

Last Updated

18-05-2024

Introduction:

The introduction explains the idea of the book behind it and the education that we acquire in our school does not contain knowledge and the importance of financial life. Financial literacy would be more beneficial for financial privilege in the context of continuous global and technological changes.

What is Being Said:

This book follows the section of the childhood of Robert Kiyosaki when he at the age of nine started to get knowledge of earning money. The book’s name comes from the real father of Kiyosaki who was poor and his friend’s father who was a wealthy man. His biological father was a professor who earned a lot yet struggled financially whereas his friend’s father who was a school drop out was a business tycoon and ended up as one of the richest men in Hawaii. Kiyosaki tried to recognize the points both of his rich dad and poor dad, however, his rich dad helped him to gain knowledge of value and to earn money.

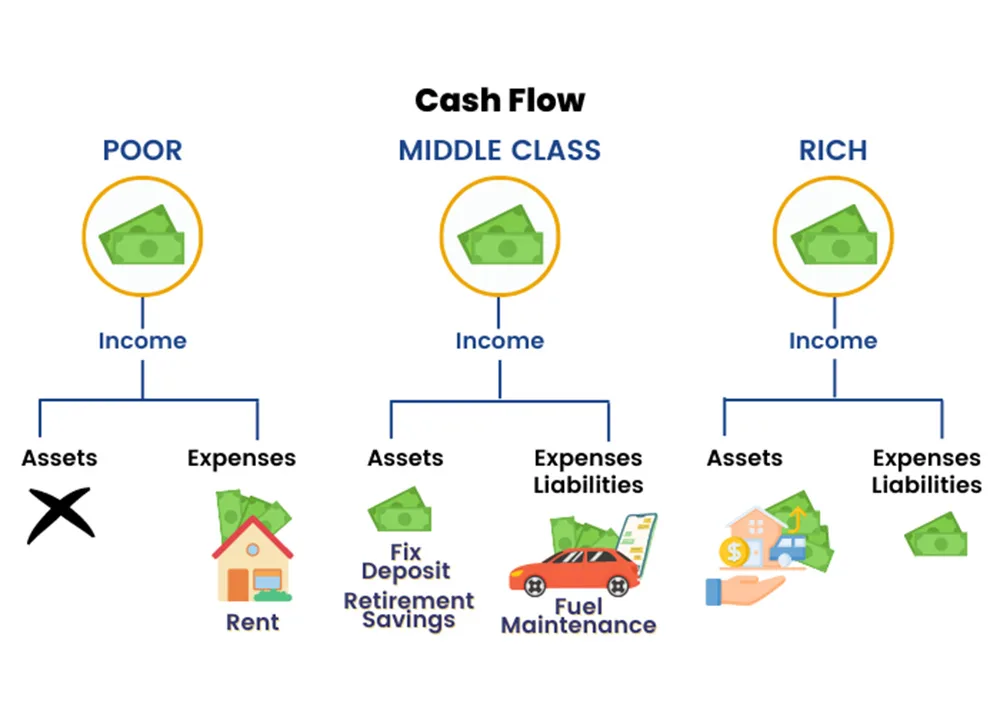

This book introduces cash flow, balance sheet, and income statements in a minimal style which is easy for everyone to be aware of. The author wishes that every kid should be taught the basics of earning money from childhood which he tells is the main motive to write this book. To get to know the difference between the basics and obligations. The importance of investing in assets has been highlighted in numerous chapters. It was called the number one and only rule. The chapters involve basic financial concepts with simple explanations. This is often continued with the life of the author or his family, a portrait of his friends.

This Book is For

Parents who want to teach their teenagers to be smart and accountable with money.

The youngsters who are looking around for money and freedom and need a venue to perform.

The one who wants to invest in assets for instance; real estate.

Important Points of Rich Dad Poor Dad PDF

| Learn Financial Literacy |

| The Rich Invent Money |

| Mind Your Own Business |

| Choose Friends Carefully |

| Have Money Work For You? |

| Pay Yourself First |

| Work To Learn |

| Overcoming Obstacles |

Learn Financial Literacy

Even today schools don’t teach us financial topics formally. It means many teenagers learn to make money from their parents. Maybe we don’t want to admit that parents always don’t have an excellent financial track record therefore they can’t give us the best financial guidance. In book-like Rich Dad Poor Dad PDf, many parents encourage their teenagers to stay in school and to work hard as much as possible while they are in school. Finally, you are getting the job and working for the sake of a monthly salary. Kiyosaki says this philosophy may help us earn good revenue but it isn’t a secret for financial build-up. Many graduates resign from schools without financial expertise. Millions of accomplished people may have successful careers but afterward, they struggle financially. Not being able to be financially astute and not planning for the future may cause a lot of financial stress.

In the United Nations, 50 percent of manpower is without allowance, and of the rest, 75-80 percent have insufficient retirement amount. It seems unfair that most of the people around us work hard yet they can’t get anywhere financially. Kiyosaki says that the thing that is missing in our tutoring is not only how to make a secured income but when we want to start earning then what needs to be done.

The Rich Invent Money

Kiyosaki says that everyone comes into this world with a special talent but their talent is suppressed due to self-doubt and fear. Kiyosaki says that intelligent, courageous, and brave people live their lives happily. People who struggle with financial matters even when they get tons of money this is the reason that they fail to take advantage of opportunities and are scared to take risks. Most of the people sit around and they wait for opportunities to come. Kiyosaki emphasizes this point that a person has to make his fortune rather than just waiting for opportunities to come next to him, that is what exactly happens in real life. The main point of the author of this book Rich Dad Poor Dad PDF is that many people don’t succeed in life because they are more scared to lose. This is the reason I found schools stupid. In school, we are taught that mistakes are such bad things and we should be punished if we would make mistakes. The author of this book Rich Dad Poor Dad PDF says that if you look upon people then you will get to know that humans are designed this way we learn everything by making mistakes. We learn how to walk by falling. It’s not like if we would fall then we will never be able to walk. People’s fear of losing something becomes the main reason for not becoming rich. “The one who avoids failures also avoids success”.

The author of the book Rich Dad Poor Dad PDF emphasizes knowledge, he says “A trained mind is a rich mind”. The author of this book classified investors into two platforms, the one who goes for packed investment and, on the other hand, those investors who invest according to their needs. Hiring people who are more intelligent than you is an important factor because they benefit from others’ knowledge. Genius investors make their knowledge foundation, therefore he takes more work from them without them even knowing. They get happy from this power of foundation which they form in their childhood.

Mind Your Own Business

The author of the book Rich Dad and Poor Dad PDF had two dads. His poor biological father was an idle player he always stood one step behind in the finance market. His rich dad, his best friend’s father was a conscious player who was always aware of his next move. In 1995, Rich Dad Poor Dad PDF author’s father used to say “Go to school and get decent marks and get a stable job.” On the other hand, his rich dad used to say, ”Mind your own business.”

Rich dad used to say this because he knew how important is self-control and this is an unfair benefit. Poor Dad didn’t use to mind his own business he would say, ”Business and government are responsible for your medical and retirement needs.” A retirement plan is part of the benefit of your package, and you are eligible for it. Rich dad would say, ”Mind your own business.” poor dad used to believe in being a hardworking and honest person. He would say, ”Search for a job and get on the ladder of a job and get your work done.” beware that companies don’t like the person who roams around a lot. People are rewarded for their loyalty but rich dad always used to say, ”Mind your own business.”

Choose Friends Carefully

One should not have friends who compare their financial statements with you. Rather than seeing their determination to become friends, we should have a friend. We can learn from our friends from the elite class and middle class. Every person has his point of view and we need to hear it mindfully. We can also learn something new. We need to know what are we doing and whether are we honest with ourselves. To build wealth, we don’t have to walk with the crowd we have to quit the matrix.

Have Money Work For You?

The majority of rich people work really hard but they consult with other people differently. The one who is well-off or the one who wishes to become richer they work hard and they learn how their money has to work. according to Rich Dad, ”Poor and middle people work for money on the other hand elite class has money to work for them.” According to the author of Rich Dad Poor Dad PDF, fear and greed lead to ignorance and poverty, and poor and middle-class work for money, it is important to deal with emotions while reasoning with them. He emphasizes a point about how opportunities keep coming and going but wealthy people are aware and quick to turn their opportunities into bars and they don’t let any opportunity get out of their hands that is what makes them different from others.

On the other hand, fearful and weak people are deprived of such opportunities because they are busy making money and securing wealth and financial freedom. A regular job is just a temporary solution for creating wealth and for financial purposes. Working hard rarely makes someone wealthy, but working smart does. The more money works for you, the less you have to work for money. That should be our motive rather than learning how we can make money. We should be learning how can we make money for ourselves. The goal should not be making more money, the goal is financial freedom.

Pay Yourself First

First of all, the imagining of paying yourself first has a prominent impact on anyone becoming sovereign. How? At least it creates a great foundation for him. ”Pay yourself first” is a quote that was first used in a book named The Richest Man in Babylon. But the author of Rich Dad Poor Dad PDF Robert Kiyosaki has turned it into deep personal financial rules. Kiyosaki has written this book, Rich Dad Poor Dad in which he explains the importance of paying yourself first and utility.

When I was reading this book the first time I felt that reading this book may have a great impact on my thinking. Since then “pay yourself first” quote has left an embedding impact on my thoughts. What makes “pay yourself first” so special is its simplicity. The secret to creating lasting financial change is to pay yourself first and then make it automatic. Saving must. Invest in yourself work for yourself, pay, and reward yourself.

Work To Learn

The sad reality is that people tend to view work as an opportunity to grow and learn. People consider work as an evil necessity that people must work overtime to earn more and more revenue. After graduating from Merchant Marine, his career was ahead of him. His first job as a third partner was at an oil tanker on a California ship. He earned approximately $42000 including overtime throughout the year, he had to work only seven months, and his poor dad was really happy about this massive amount and on success of his son. However, after six months Robert resigned from Standard Oil. He took part in the Marine Corps.

His poor dad threw tantrums but his rich father congratulated him on this. He got into the Marine Corps to learn more skills. He wanted to learn to become a pilot and how I have to guide someone in their hard time. Robert knew that the leadership skills that he learned in the corps would benefit him in his business and life. After a tour of duty, he got a chance to become a pilot in a commercial airline on a permanent salary. However, instead of this, he did a job at Xerox as a salesman. Although he could spent his pleasant life as a pilot he wanted to learn the skill of sales. He knew what he learned at the Marine Corps would benefit him in becoming a wealthy man. Once again his poor dad was in a rage and his Rich Dad was quite cheerful. A day without learning is a day wasted.

Overcoming Obstacles

Kiyosaki says that the difference between rich and poor people is how they deal with their fears. if a rich man has lost he faces this bravely. they take risks, and they invest according to their knowledge, but from time to time they may lose money. At all other times, their investment pays off and their income is enough. The poor man never loses money because he is afraid to take risks, they are risk avoiders. they are scared to invest so that they don’t lose money but they don’t get profit as well. Five reasons why financially cultivated people are not economically sovereign:

Fear, cheesiness, laziness, bad habits, arrogance.

The rich man is inspired by their failures because they become lessons for them, they learn from them and do better than this. poor or middle-class are not financially successful, because for them losing money is a greater sorrow than the happiness of being rich. they choose to live a simple life that is secure, simple, and safe. They can afford to get fancy cars and spacious houses yet they are scared to invest in such big things. mostly big reason for financial struggle is that they don’t play to lose, not play to win.

Focus is the key that leads a person towards being rich. unlike the brains of poor and middle-class people who are afraid to take risks, mostly rich people put their eggs in one basket and focus. they focus until they get successful. a clever investor knows that the worst time is the best time to invest and earn more money. When everyone is scared to do work, then a clever investor does not feel shame enough to pull out the trigger and get the prize. winners analyze and cynical criticism. Rich Dad explains that criticism is not the solution of anything rather meaningful analysis is a way to find the way.

Analysis helped many rich people to open their eyes and find opportunities that nobody knew. the thing that everyone loses to find it is the biggest success. losers lose and the winners get impressed by their loss.in today’s world, being busy getting important things done and just being busy may be the cause of confusion. Actually, according to Rich Dad Poor Dad, busy people are mostly lazy people. the key to success is to pay yourself first. once you pay yourself the burden of paying taxes first. the creditor will give you extra credit to make you work harder than before.” i have done extra jobs, started other new companies, and traded in stock marketing, just to make sure that the others do not shout at me. this pressure forced me to do more hard work and forced me to think, overall, when it comes to money it has made me more clever. if I paid myself at the final I would not feel more pressure but I would break down. the greater the obstacle, the more glory in overcoming it. we must have set realistic goals if we are working hard to be successful but with accepting failures also.